Smarter investors than me have written about the velocity of money before. Moving money quickly through investments, investing forward and generally getting richer faster is the general thrust of the concept. It hurt my head the first time I heard it because it was proposed as a different, faster method to straight forward compounding.

The reason it hurt my head is because it is still compounding. The difference is you are compounding the compounded return to make a higher overall return. Rob Minton has explained this well and called it double or triple compounding.

Here’s the gist:

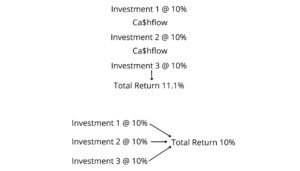

You could buy an investment that pays 10% in cashflow through rent or dividends or interest or whatever. That 10% can be immediately reinvested at 5% and now you’re making not 15% but 10.5%(10% +5% of 10%) on your original capital. That half percentage might not sound very exciting up front but remember that it is essentially a free investment to you because it didn’t need your original capital. You’ve outsourced your investing to your profits, to thin air.

Now, you might correctly point out that this is the same as making an initial investment at 10.5%. That’s what initially confused me. The difference of course is that it is much easier to chain a few smaller return investments together for a big return than it is to create big returns from a single investment. It just takes the pressure off.

This means that various investing approaches can be mingled together to create vertical cashflow systems instead of many disparate horizontal systems. You can see in my lovely graph below that layering your investments quickly runs to a mathematical limit. Keep in mind that I am strictly talking about reinvesting any cashflow you receive from these investments. The conservative numbers I have used might not look like much but consider that 11% is 10% better than 10%. I’m talking about giving yourself a permanent raise by rearranging your investments. You could even use this approach to match your current investment return with less risk by targeting lower returns and layering them. You’ll note that the higher the return of the first investment in the chain, the greater your overall return.

This also opens a way to use different investment strategies together. Say you have a higher risk and higher return strategy. Well maybe you leverage that strategy by using it first in the chain of investments. Cashflow from the riskier investment goes into less risky investments at a higher rate. That’s one way.

Or keep the foundation stable with lower risk investments and then use the higher risk strategy on the cashflow that results to leverage your returns on the back end. You can mix and match how your investments relate to each other. As long as on some level you’re not paying for an investment yourself directly you’re using this technique to your advantage. I bet that once you get the taste for not buying an investment yourself you’ll be hooked.

Over time, you’ll make more money and do it more safely. That’s my understanding of velocity of money or compounding your compounding or whatever you choose to call it. Use the same dollar multiple times!